Beautiful Work Tips About How To Improve Asset Turnover

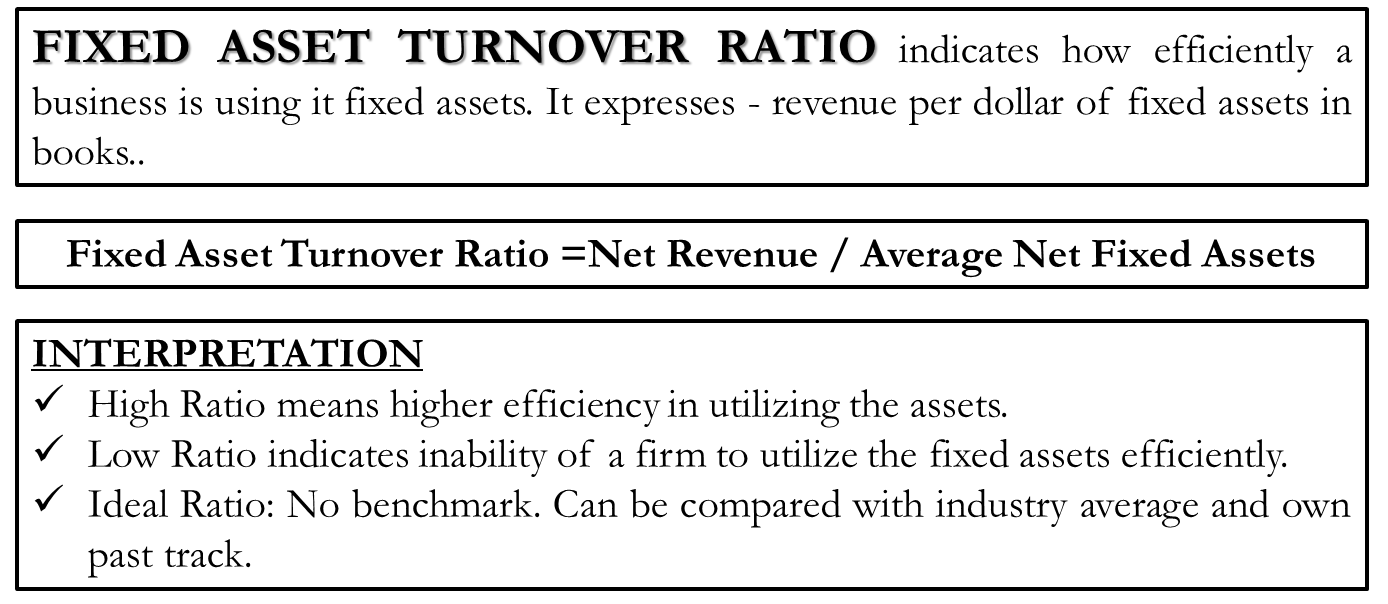

The fixed asset turnover ratio (fat) is, in general, used by analysts to measure operating performance.

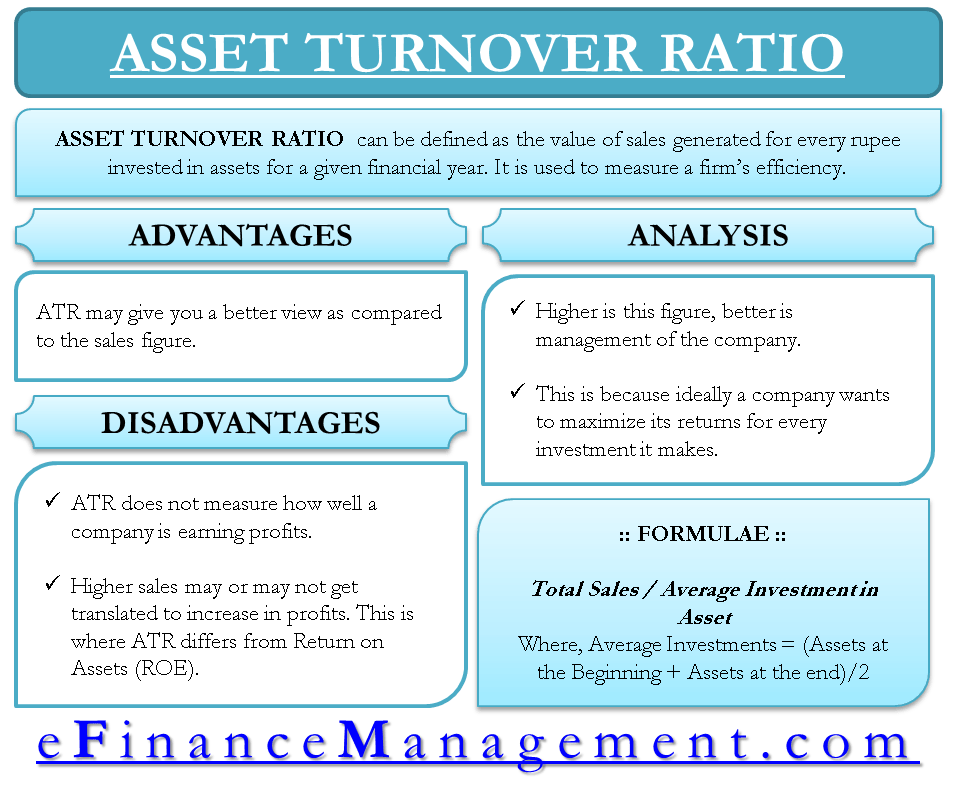

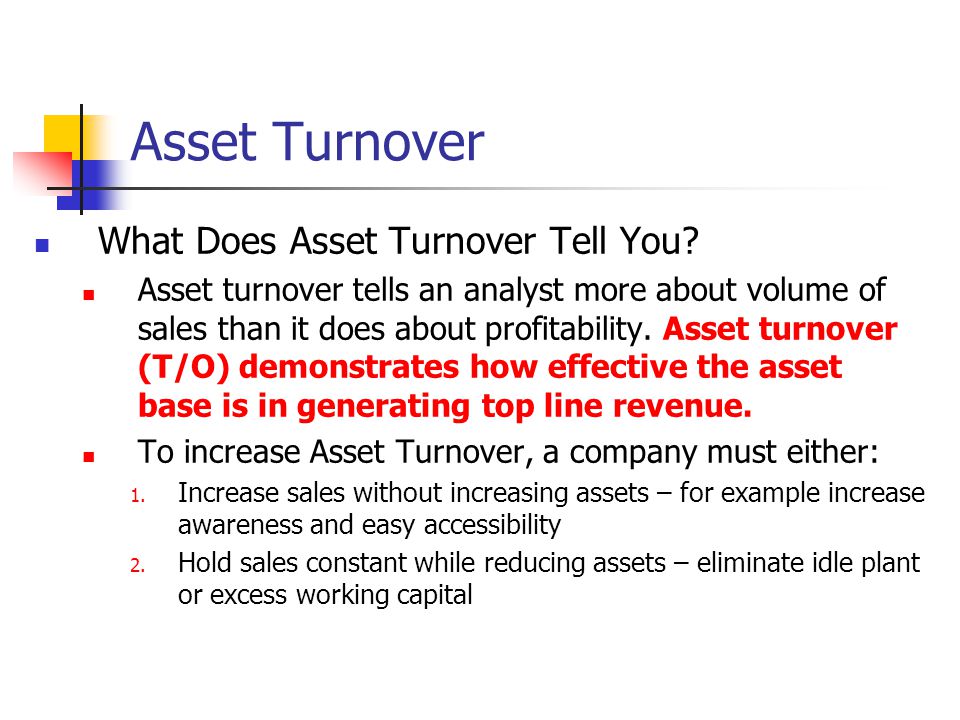

How to improve asset turnover. The higher the asset turnover ratio, the better the company is performing, since higher ratios imply that the company is generating more revenue per dollar of assets. Companies can artificially inflate their asset turnover ratio by selling off assets. How to improve the asset turnover ratio.

Fixed asset turnover = net sales / average fixed assets. Net sales are the amount of revenue generated after deducting sales returns,. How to improve the fixed asset turnover ratio.

This efficiency ratio compares net sales (income statement) to fixed. Reducing the amount of fixed assets on the balance sheet. The equity multiplier is a calculation of how much of a company’s assets is financed by stock rather than debt.

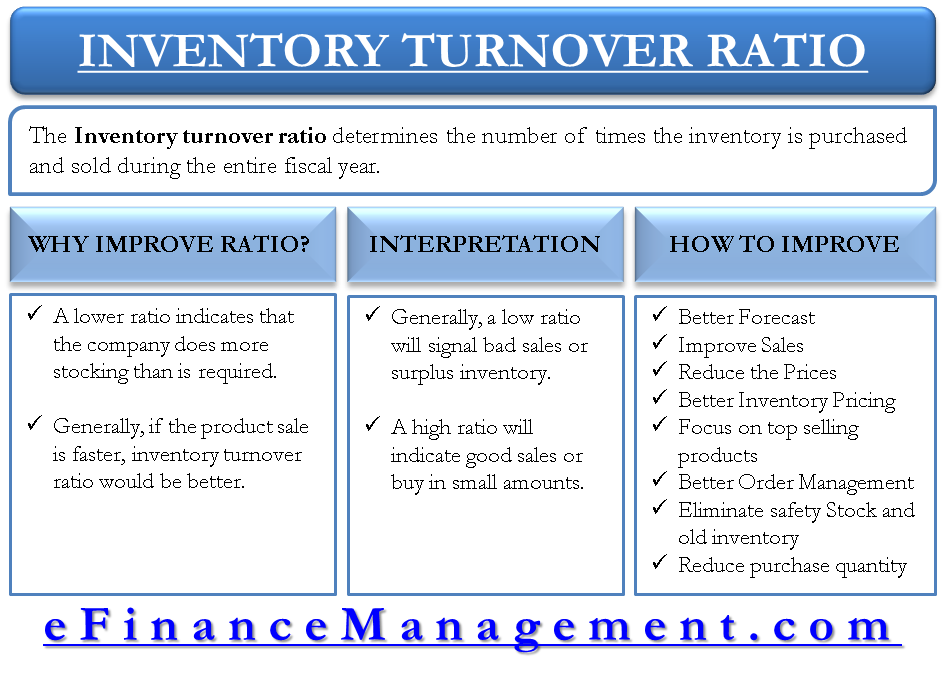

Companies can attempt to raise their asset turnover ratio in various ways, including the following: Improving asset turnover and thus the number of deals has long. This method can produce unreliable results for businesses that experience significant intra.

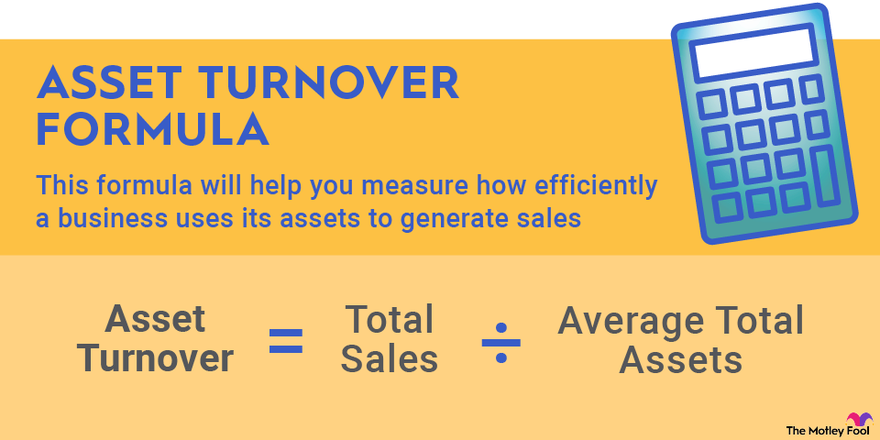

This means that you should keep a close. Asset turnover ratio = net sales revenue / average total assets. The assets might utilization be proper, but the sales could be slow resulting in a low.

There are a number of ways to improve the fatr, including: Divide net sales by the average of total assets to get the net asset turnover ratio. One way to increase profitability without changing profit margins is to increase the number of deals carried out.